Financial compliance is the backbone of how modern enterprises protect customer trust, avoid regulatory trouble, and keep financial data honest. And with regulators tightening the rules every year, the stakes have only gotten higher. Today, one overlooked privilege, one unauthorized access, or one missing audit trail can turn into an expensive problem. That’s why organizations across banking, insurance, healthcare, and fintech are rethinking how they monitor, store, and protect financial data.

Before we get into why enterprises rely on Oracle AVDF, let’s step back and talk about the bigger picture.

Why do enterprises need financial compliance?

Financial compliance ensures your business stays within legal, regulatory, and operational boundaries. It protects the integrity of your financial reporting and prevents intentional or accidental misuse of data.

Here are the pressures businesses face in the real world:

Increasing regulatory scrutiny

A U.S. healthcare payer recently paid millions in penalties because it couldn’t produce complete audit logs during a federal review. The issue wasn’t malicious activity, it was incomplete tracking.

Growing internal access risks

A Fortune 500 retail chain discovered a mid-level IT employee was repeatedly accessing credit card information out of curiosity. It wasn’t fraud, but it was a compliance failure, and it triggered a full audit. Their biggest problem? They had no centralized view of privileged user activity.

Rising fraud and unauthorized access

Banks and fintechs are seeing more internal misuse, especially around financial reporting systems. Insider threats now account for nearly 25% of financial data breaches, according to Ponemon.

Higher expectations for accuracy

Auditors now expect real-time data integrity, not quarterly cleanups. If your internal controls can’t produce consistent, unaltered audit trails, your business will struggle during annual audits.

These examples are why companies, from regional banks to global insurers, need a strong audit and monitoring foundation.

How can Oracle AVDF help?

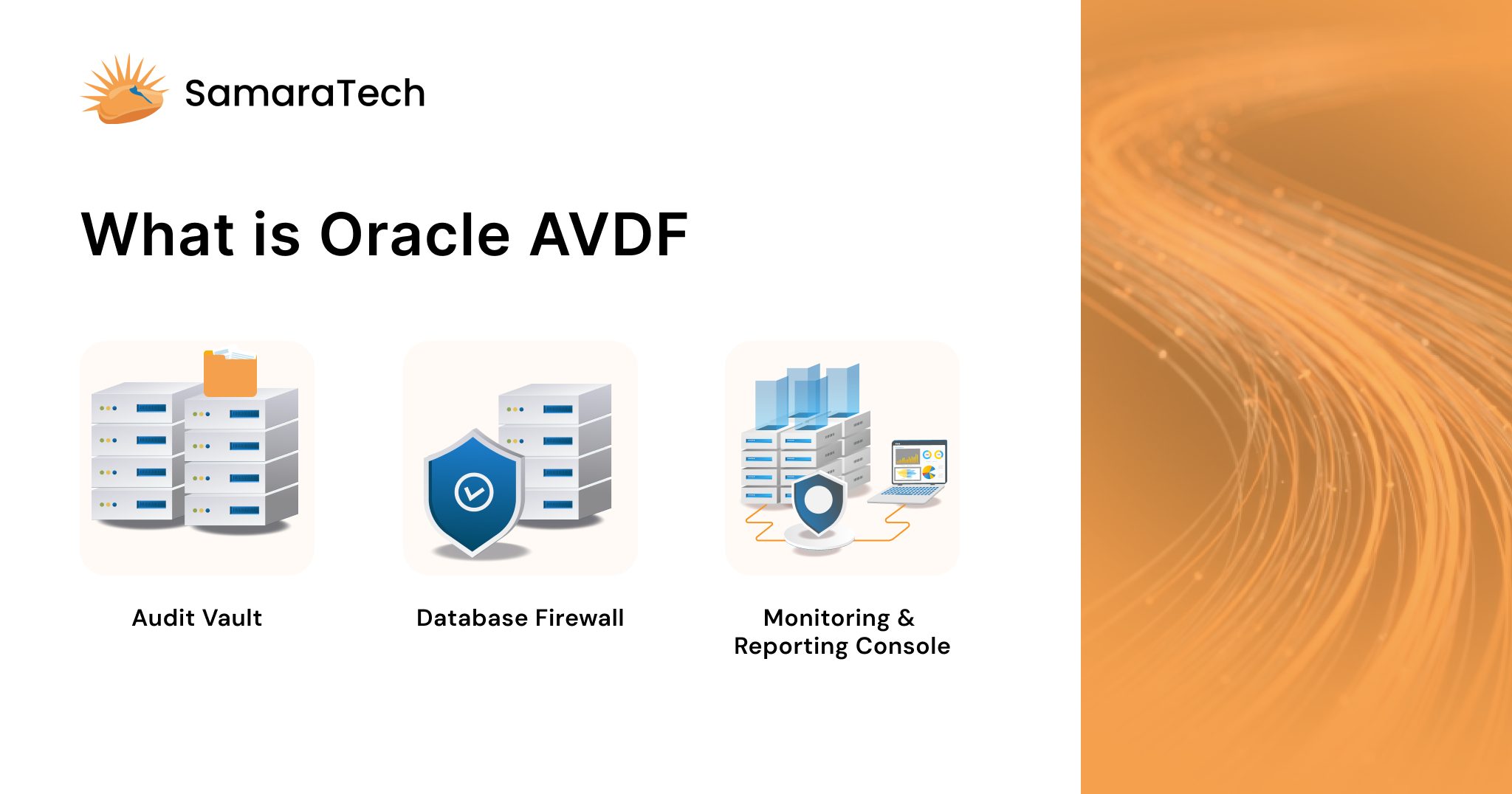

Oracle AVDF (Audit Vault and Database Firewall) is an enterprise-grade database security solution designed to strengthen financial compliance, protect sensitive data, and ensure complete audit integrity.

In simple terms, Oracle AVDF:

- Tracks all database activity

- Stores audit logs in a tamper-proof central repository

- Detects suspicious or unauthorized access

- Blocks risky activity using the database firewall

- Helps you respond to regulators with accurate, automated audit reports

It unifies your enterprise data protection, secure database auditing, and real-time monitoring into one integrated platform.

Enterprises trust Oracle AVDF because it gives them the visibility and assurance they need to operate safely in a heavily regulated environment.

Why Oracle AVDF for financial compliance

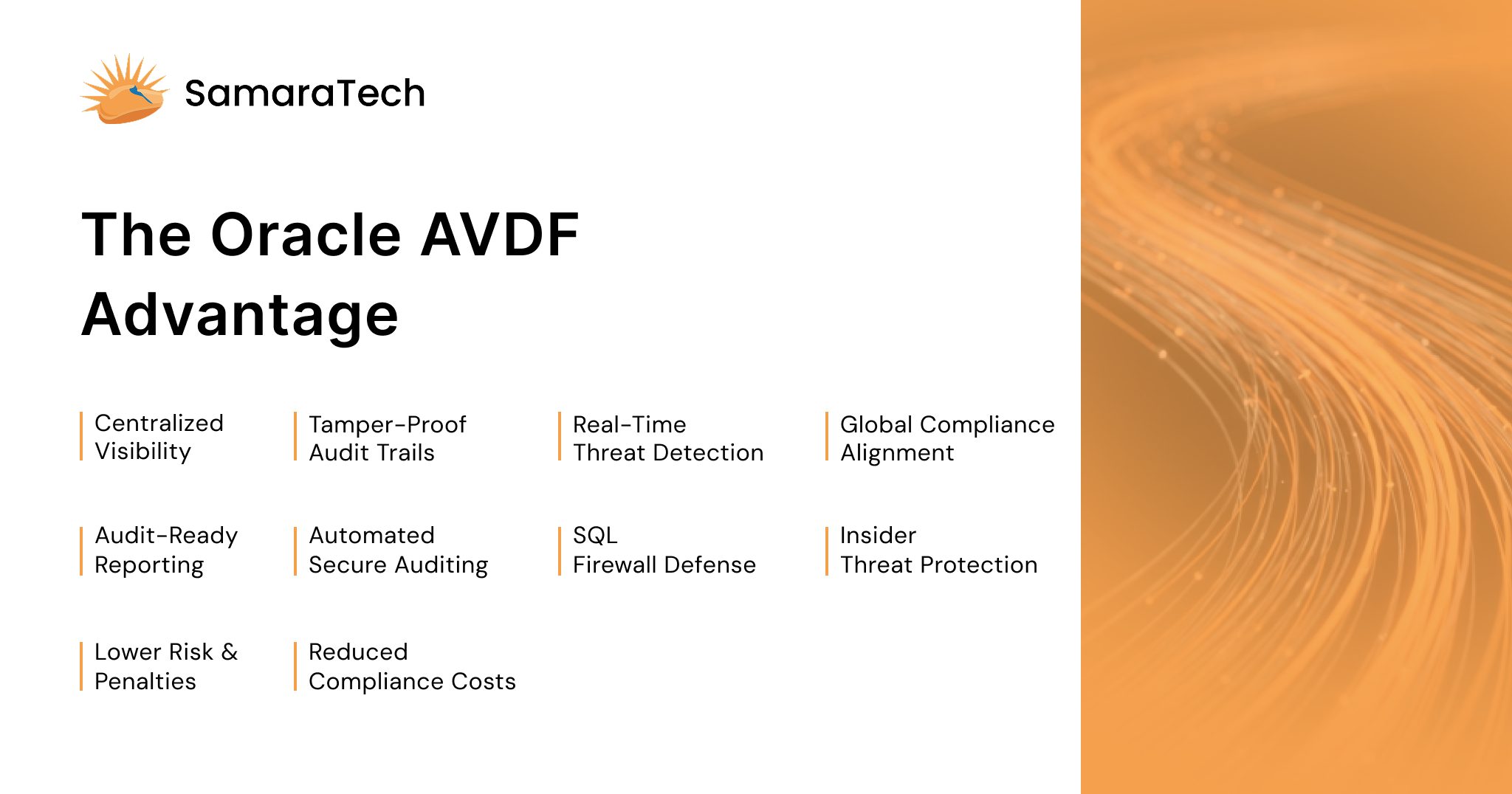

Let us look at some reasons why enterprises across the world trust Oracle AVDF to strengthen financial compliance, reduce risks, and secure their most sensitive data.

Offers complete visibility across all databases

Oracle AVDF consolidates audit logs from multiple sources, Oracle databases, non-Oracle databases, operating systems, and directories. You see every user, action, and access attempt in one place.

This level of visibility reduces blind spots, which is critical because 51% of breaches go undetected for months.

Provides tamper-proof audit trails

Regulators expect audit data to be accurate and unaltered. Oracle AVDF stores audit logs in secure, write-once repositories that no privileged user can modify, not even DBAs.

This ensures the integrity of your Oracle database audit data, which is a fundamental requirement for financial compliance.

Reduces compliance risks with real-time alerts

Oracle AVDF detects suspicious behavior like unauthorized logins, privilege escalation, or abnormal data access. It alerts your team instantly.

This proactive monitoring addresses the fact that 39% of compliance failures stem from late detection of risky activity.

Simplifies global regulatory compliance

Whether your business needs to meet SOX, PCI-DSS, GDPR, or other industry regulations, Oracle AVDF provides out-of-the-box reports and policy templates aligned with these frameworks.

This cuts down compliance preparation time significantly. Deloitte estimates companies spend 40% of their compliance time preparing audit evidence.

Protects against insider threats

Insider misuse accounts for 25% of financial data breaches, and Oracle AVDF addresses this with strong privileged-user monitoring.

Every action taken by DBAs, developers, and internal users is logged, analyzed, and reported, reducing your exposure to fraud, data tampering, and policy violations.

Strengthens enterprise data protection

Oracle AVDF inspects SQL traffic through its database firewall. Suspicious queries are blocked before they hit your database.

This protects against SQL injection attempts, unauthorized table access, and changes to financial data. In short, Oracle AVDF reinforces your core database security.

Automates secure database auditing

Manual audits are slow and prone to human error. Oracle AVDF automates most of this work:

- Audit data collection

- Activity logging

- Report generation

This ensures accuracy and consistency while freeing your teams to focus on higher-value tasks.

Reduces the cost and complexity of compliance

Instead of using separate tools for logging, monitoring, alerting, and reporting, Oracle AVDF consolidates everything.

This reduces:

- Operational overhead

- Tool sprawl

- Integration costs

According to IDC, tool consolidation saves enterprises up to 30% in compliance-related operating costs.

Delivers regulator-ready reporting

Auditors expect clear, complete evidence. Oracle AVDF generates structured reports that simplify financial audits:

- Privileged user activity

- Schema change reports

- Policy violations

- Access logs

- Trend analysis

Businesses that use Oracle AVDF report up to 40% faster audit cycles.

Minimizes exposure to fines and penalties

Financial penalties can escalate quickly.

- SOX fines – Up to USD 5 million

- PCI-DSS violations – USD 500,000 per incident

- GDPR fines – Up to 4% of global turnover

By ensuring accurate logs, early threat detection, and complete visibility, Oracle AVDF significantly reduces your risk of non-compliance and regulatory penalties.

Conclusion

Financial compliance today demands accuracy, transparency, and consistent monitoring. Traditional tools fall short because they can’t provide centralized oversight, tamper-proof logging, or real-time detection.

Oracle AVDF for financial compliance bridges this gap. It gives you the visibility, control, and assurance you need to operate safely, reduce compliance risks, and protect your most sensitive financial data.

Enterprises trust it because it works, consistently and at scale.

Maximize the value of Oracle AVDF with SamaraTech

SamaraTech brings deep expertise in deploying and optimizing Oracle AVDF for enterprises across industries. As an Oracle Gold Partner with decades of technical experience, we help you build a strong, compliant, and secure audit environment. Our team manages the complete lifecycle, from assessment to implementation, configuration, and ongoing monitoring, ensuring your secure database auditing and enterprise data protection are always aligned with regulatory expectations.

With SamaraTech, your business gains a robust Oracle AVDF framework that strengthens financial compliance, reduces risk, and delivers long-term operational confidence.